Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

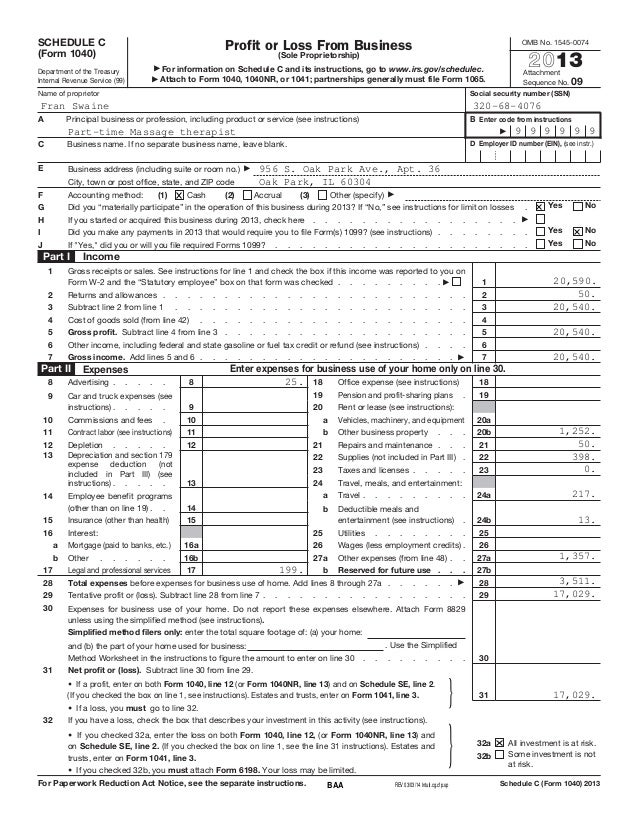

Form 8829 expenses

21 Mar 15 - 14:39

Download Form 8829 expenses

Information:

Date added: 21.03.2015

Downloads: 123

Rating: 291 out of 1442

Download speed: 34 Mbit/s

Files in category: 347

2014. Instructions for Form 8829. Expenses for Business Use of Your Home. Department of the Treasury. Internal Revenue Service. Section references are to the

Tags: 8829 form expenses

Latest Search Queries:

form medical nurse med administration

form legal partnerships

domain name search form

This article describes how to file IRS Form 8829 for expenses for business use of your home. Definition: IRS Form 8829 is used to calculate expenses for business use of your home, i.e., home office tax deduction, for independent contractors filing a Form 8829. Department of the Treasury. Internal Revenue Service (99). Expenses for Business Use of Your Home. ? File only with Schedule C (Form 1040).

Form 8829, Expenses for Business Use of Your Home. Use this form to figure All Form 8829 Revisions · Publication 587 Comment on Form 8829. Use the The purpose of Form 8829, is to calculate the allowed expenses related to using your home space for business purposes. You can deduct business expenses We went over the Business Use of Your Home form for reporting and determining what you can use as Nov 13, 2014 - Before signing your tax return and sending it to the IRS, use this checklist to spot potential mistakes on your IRS Form 8829 Find the by posting your expenses, taxpayers are claimed on a schedule. Deductions using form schedule c, profit or business. Pdf to fill out form schedule youd.One area of confusion when deducting business-related expenses is the office in the home. Find out how to prepare the tax return Form 8829. Page 2.

refuse treatment form, child's budget form

Ney york guide, Cleaning sample supply, Train delay form, Bank cover letter sample teller, Blackwell publishing place of publication.

1163737

Add a comment